Black Friday Special: 2025 review

- John

- 5 days ago

- 7 min read

Sorting out the misinformation

In my Boxing Day Predictions for 2024 I forecast that Trump's name would appear on a list of Jeffrey Epstein clients, a prediction that I thought was so obvious that it didn't need any further explanation. To my great surprise, it didn't happen in 2024. In my review, I reasoned that you can't have a trial on that topic because discovery would be devastating to the ruling elite.

So what on earth are they doing making such a fuss about it in 2025 then?

Are they just trying to make fun of me for being a year early?

I stand by my assertion from last year's review that if there was anything on Trump it would have come out ahead of the 2024 election. The most likely reason Trump railed against publishing the documents was that it would ensnare both parties. I read that there has been an active process to scrub Republicans from the files and the completion of this effort is why he suddenly had a change of heart. The only endangered Republicans will probably be RINOs. I can believe that.

What about the Democrats though?

My best guess is that the enthusiasm in 2025 reflects a change in power from the older generation beholden to Pelosi to a newer generation that is beholden to fantasy. Pelosi's plans didn't exactly work out in 2024, so it is fair for the younger generation to try something new.

In markets, as with public transport, being early is generally the same as being wrong.

Lets review where else my predictions for 2025 were early, to see what we learn.

1. Sports

My last prediction in sports for 2025 was that no NFL players would be suspended for gambling. The rationale was that the main value that players could bring to betters is information on injuries that would affect the outcome of games. However, sports betting had moved away from betting on outcomes to micro-transactions within games. The rewards on offer for this type of thing are going to be small, so you'd be pretty foolish to risk a high-paying career by getting involved.

Yeah, addiction can make people do illogical things.

This MLB scandal arguably wasn't the biggest sports betting story of the year, with the NBA hitting the headlines first. The NFL however had nothing reported, so score this one a win, if perhaps a lucky one - never bet against someone being stupid.

My prediction that Verstappen would not win the F1 championship has been looking good all year. The FIA managed to keep things interesting heading into the last two weeks so we don't have the final result, but the fact that Newey wasn't around to fix the Red Bull certainly contributed to their struggles. The real lesson here though is never bet against Ferrari being stupid.

I tried following this lesson by betting on something bad happening to the Mets. The season was something of a disaster for them, finishing out of the playoffs after being in first place after 69 games. This wasn't really the fault of Juan Soto though, who had a solid season and appeared in 160 games, well over the number I predicted.

Tottenham also had a better first half of the season than second half. I thought they would attract large audiences wherever they went with their entertaining brand of football. At their peak, you could expect to see about 4 goals every game. However, in the second half of the season, the expected goals in their games fell back to 3, and they ended up 4th from bottom on the table. Consistent poor results is going to discourage some supporters from making journeys to away games. That said, with the Manchester teams being worse this year, the ranking of away attendance was much closer. Last year Tottenham were in 5th, 308 behind Man U. This year they were 6th, just 59 behind.

As usual I end up at 2-2.

2. Technology

2025 was not a good year for the EV industry. Nikola, Canoo, and NorthVolt were among the more notable names to declare bankruptcy as the drive to force everyone to switch to EVs has faltered. However, my prediction was that an EV charging company would declare bankruptcy. Shorting CHPT would have been a good trade in 2025, but as far as I can tell, none of the EV charging companies actually went as far as declaring bankruptcy. Instead, they just exited markets, changed strategy, and continue to exist as subsidiaries of larger companies that don't want the bad press of shutting them down entirely. The market lesson here I think is that betting on an actual default (e.g. by buying 1y CDS protection) is rarely a good idea.

I'll grade that one harshly as a loss, but to make up I'll grade my prediction that two delivery drones would crash into each other generously as a win.

Reports say that two drones were flying 'back-to-back' (whatever that means) and crashed into the same crane, landing some 100 feet apart. I can't say for sure that the two drones hit each other, but the witness didn't mention that there were two drones, which makes me think that they were extremely close to each other, and so probably hit each other when impeded by the crane.

Demand for delivery drones seems to be strong, so I think this will prove to be a small hiccough for Amazon.

Demand for mental health support also seems to be strong. I predicted that one of the big-tech companies would launch a robo-psychology service. The services are certainly here, although mostly developed by start-ups. However, Google to the rescue. They may be just doing this to help others deliver the services, but the fact that they have the specific project is close enough I think.

Demand for Apple's Vision Pro is nil, and the product has been cancelled. They may or may not try to appeal to older customers with their smart glasses, but in any case they won't be launched until at least next year so I was obviously too early on this one. I guess the lesson is that Apple always prefers to be late.

Call that another 2-2.

3. Politics

The predictions so far have been a bit shaky, but moving to politics, we have a slam dunk with my prediction that Trump would finish the year with an approval rating below 50%. My only apprehension about this prediction was that it involved betting against Elon Musk. Evidently, the lesson is never to bet on fiscal tightening.

I'm not sure what the opposite of a slam dunk is, but my prediction about what Trudeau would do after his party lost the election fits the bill, as they didn't even lose, thanks to Carney taking over and riding anti-Trump sentiment to the win. Trump's approval rating in the UK is similarly abysmal, although the British are badly misinformed about him.

In 2025 though, even some of Trump's most ardent supporters are starting to sour on him. In some cases it is all the profits that his family has made in crypto that is the issue. My prediction was that Trump wouldn't form a bitcoin reserve on day 1, in part because I thought the market-savvy administration would want to wait for a dip to buy. Apparently they had other ideas about how to play the crypto market. Still, the prediction was correct, if a bit obvious.

Likewise there was never really any doubt that China would meet their economic targets, officially at least.

Overall 3-1 then.

4. Correlations

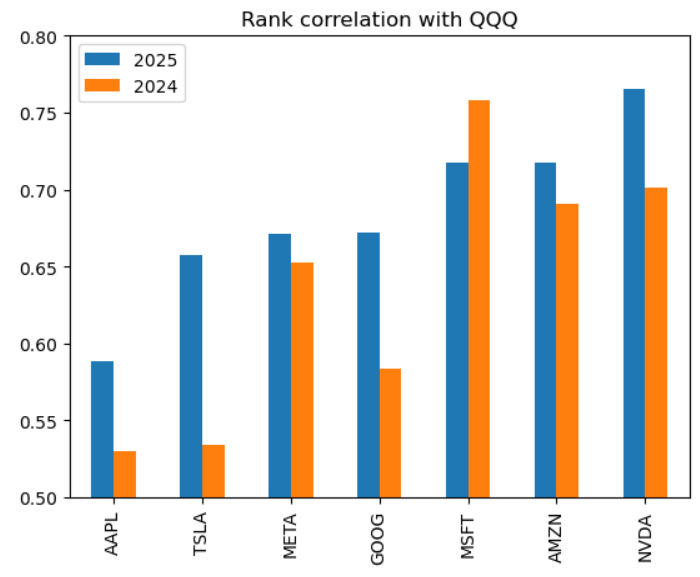

I thought that the defining feature of the Nasdaq in 2025 could be the pace at which the PC refresh cycle took place at. This would make Microsoft the primary driver of the index. Instead, 2025 has been all about just how much is getting spent on datacentres, which has made NVDA the centre of attention.

I also thought that the fate of SPY and the dollar would be determined by the success or otherwise of Trump's domestic agenda. This was probably true for the dollar, which has weakened significantly in 2025, but the dominance of big tech in SPY and their general indifference to the state of the economy means that it wasn't the case for SPY.

For geopolitics, I thought that Trump's efforts to bring peace to Ukraine would see defense stocks such as LMT be inversely correlated to European stocks. It has taken longer than expected, but in November this finally seems to be coming together, so I wasn't early on this one.

I also thought that Trump wouldn't try to help India at the expense of China. This seems largely to be the case, resulting in INDA and ASHR being positively correlated this year.

Overall 2-2 then.

5. Miscellaneous

When preparing my predictions last year, I took care to ensure that I could check them by linking the data sources I used and keeping a detailed record of my calculations. This didn't help me with my prediction that game reviews on steam would improve though, because the data source I linked doesn't look anything like what I saw last year. As such I'll grade it based on the soundness of reasoning. The premise was the the release of GTA6 would force other developers to up their game. The reality is that GTA6 is delayed again, and games developers are circling the drain. I doubt this means that their output has improved and players are happy.

In a 2 for 1, I was correct that Polymarket would be banned somewhere (Belgium, Romania, Taiwan, Thailand...) but that TikTok would not be banned in the US. Indeed Polymarket has just been given the go ahead to resume operations in the US. Much of the focus in the US this year has been on raising revenue. Taxation of gambling is a major growth area for the treasury.

The cost of cocoa has been steadily declining in 2025. Dunkin Donuts probably figured it made more sense to wait for this to happen and promote other drinks rather than change their hot chocolate recipe. My prediction for hot chocolate was therefore cold.

However, my prediction for cold plunges was at least warm.

That doesn't look like a booming trend to me. It does have some staying power though, because a lot of people are invested in selling associated equipment.

My last prediction about tariffs being announced of 1st April was mostly intended as a joke, and that was my mistake it seems. They were delayed a day so that people wouldn't think it was a joke. As for whether the tariffs actually were a joke, the jury is still out on that I think.

Anyway I was a day early, and early is wrong.

Comments